One of the more interesting aspects of the Paris Air Show or its even-year Farnborough counterpart is the chance to learn just how many more commercial aircraft the manufacturers expect to produce in their long-term forecasts, usually going out some 20 years. How much is the commercial aircraft market worth, in other words?

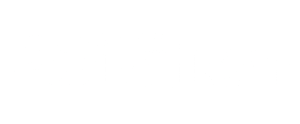

The Boeing Market Outlook (BMO), released on the first day of the show under the stormclouds still hanging over the 737 MAX, and the engine delays also darkening the days of the 777X, suggests for the first time more than 50,000 jets will be needed, ranging from sub-90-seater regional jets all the way up to the largest twinjets and freighters. The 50,660 aircraft is a rise from last year’s 20-year forecast of 48,540, and 40,040 of these aircraft will be new: just 6,620 will be existing aircraft.

“Aerospace and defense continues to be a healthy and growing industry over the long term, boosted by strong fundamentals across the commercial, defense and services sectors and demand that is geographically-diverse and more balanced between replacement and growth than ever before,” Boeing chief financial officer and executive vice president of enterprise performance and strategy Greg Smith said in a statement on Monday (European time).

In addition to the 20-year forecast, Boeing said there was projected demand for commercial aircraft worth US$3.1 trillion over the 10 years to 2028.

On the defence and space side of the business, Boeing predicted “$2.5 trillion of defense and space opportunities during the next decade as governments modernize military platforms and systems, pursue new technologies and capabilities and accelerate exploration from sea to space”.

Defence, Boeing said, covered “military aircraft, autonomous systems, satellites, spacecraft and other products”.

The services market for the commercial, defence and space sectors would be worth US$3.1 trillion over the next decade.

With a growing international focus, the company imagines that “the projected spending – spanning military aircraft, autonomous systems, satellites, spacecraft and other products – continues to be global in nature with 40 percent of expenditures expected to originate outside of the United States.”

Commercial aircraft deliveries to be dominated by Asia Pacific

Over the next 20 years, airlines were expected to need 44,040 new aircraft worth some US$6.8 trillion. This was up from 42,730 aircraft in the prior year’s BMO.

The demand was split between 19,210 replacement and 24,830 new aircraft as airlines added capacity and sought greater fuel efficiency with more modern jets.

Boeing’s forecast comes despite some mutterings of a potential slowdown or bubble in commercial aviation, but the US manufacturer was still bullish on the commercial market.

“Time and again, commercial aviation has shown itself to be extremely resilient,” Boeing commercial marketing vice president Randy Tinseth said.

“Notwithstanding some recent moderation in passenger and cargo traffic growth, all indications are pointing to our industry sustaining its unprecedented streak of profitable expansion.

“In fact, we see a market that is broader, deeper and more balanced than we have seen in the past. The healthy market fundamentals will fuel a doubling of the commercial fleet over the next two decades and a massive ecosystem of lifecycle solutions to maintain and support it.”

Unsurprisingly, Boeing continued to forecast substantial demand in the single-aisle market, the largest commercial airplane segment, consisting of 32,420 airplanes costing some US$3.8 trillion.

Boeing said the growth was driven “in large part by the continued strength of low-cost carriers, healthy replacement demand and continuing growth in Asia Pacific”.

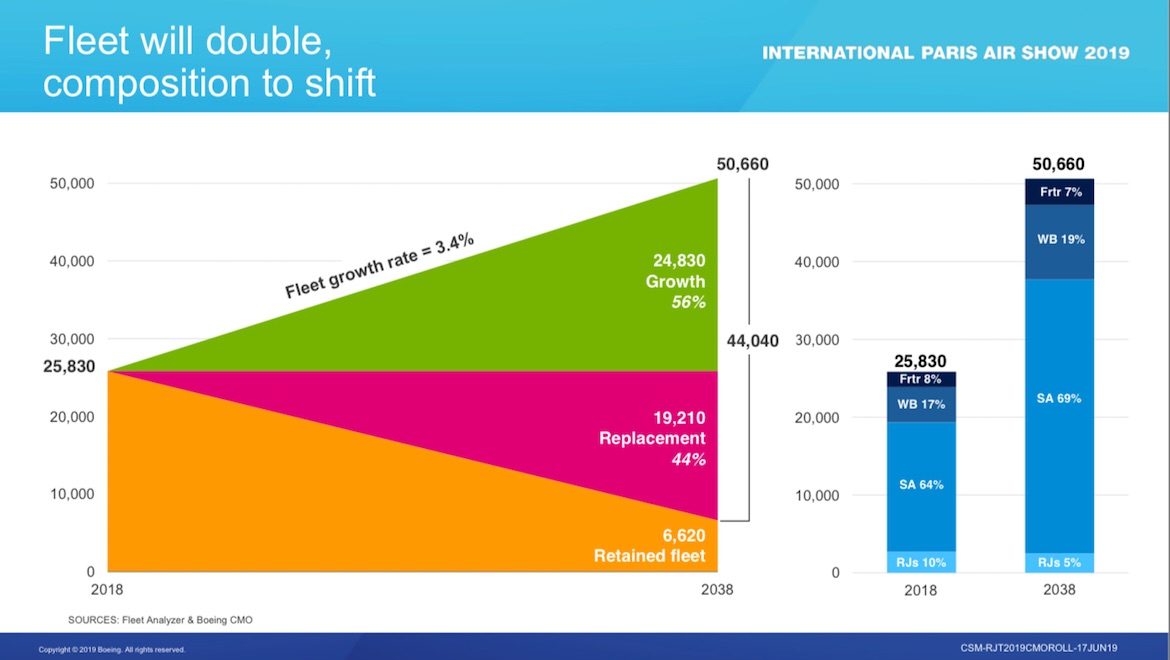

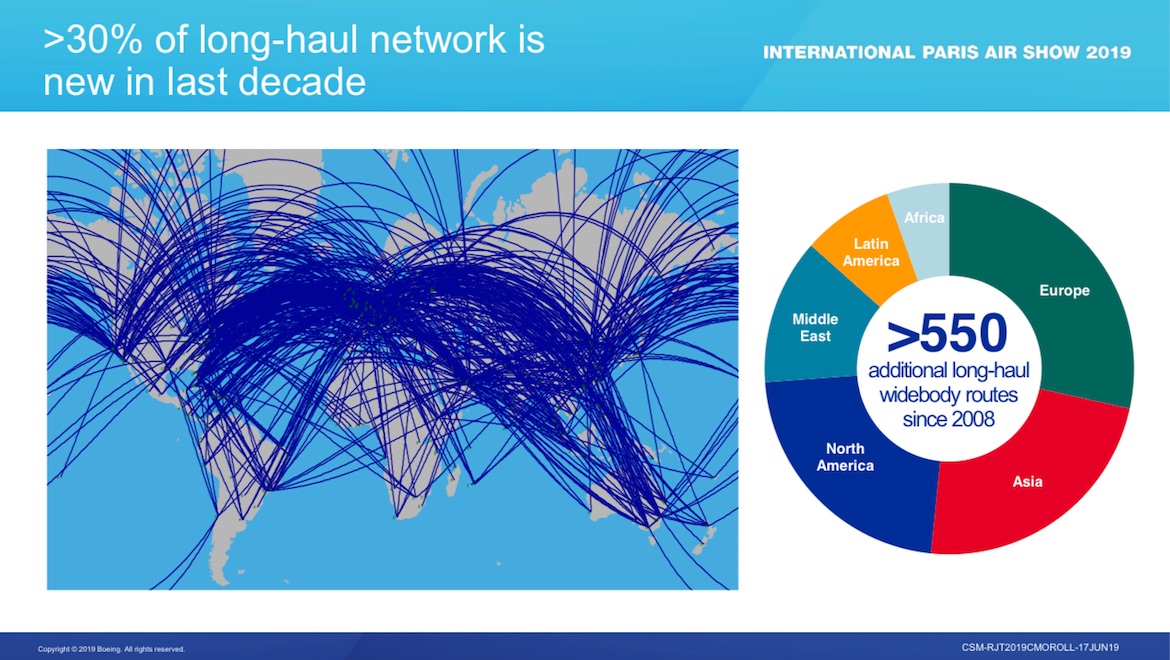

On the widebody side, Boeing forecast demand for 8,430 aircraft worth over $2.6 trillion, with demand based, in part, on the expectation a significant wave of older airplanes would need to be replaced beginning in a few years, as well as the combined demand for new large freighters and the replacement of large passenger airliners being converted to freighters.

Asia-Pacific, including China, is expected to account for 40 per cent of total aircraft deliveries and 38 per cent of the total services market.

Significant demand for services

Boeing said the global aircraft fleet would continue to generate significant demand for aviation services, including supply chain support, such as parts and parts logistics, maintenance and engineering services, aircraft modifications and airline operations.

For commercial aircraft, the services industry was expected to grow by 4.2 per cent a year over the next two decades to US$9.1 trillion.

“This is a very dynamic and exciting marketplace, one that is driven by new technology and a relentless drive for greater efficiency, reliability and safety,” Tinseth said.

“On the technology front, we see operators using drones to inspect airplanes, and manufacturers delving into data analytics for insights to improve airplane maintenance and performance. Above all, operators are looking to providers to offer solutions that help them serve their customers more efficiently and reliably.”

Major categories in the services forecast included a $2.4 trillion market for maintenance and engineering, which covered tasks required to maintain or restore the airworthiness of an aircraft and its systems, components and structures.

Another major category is the $1.1 trillion market for flight operations, which covered services associated with the flight deck, cabin services, crew training and management and airplane operations.

Boeing lifts demand for pilots and technicians

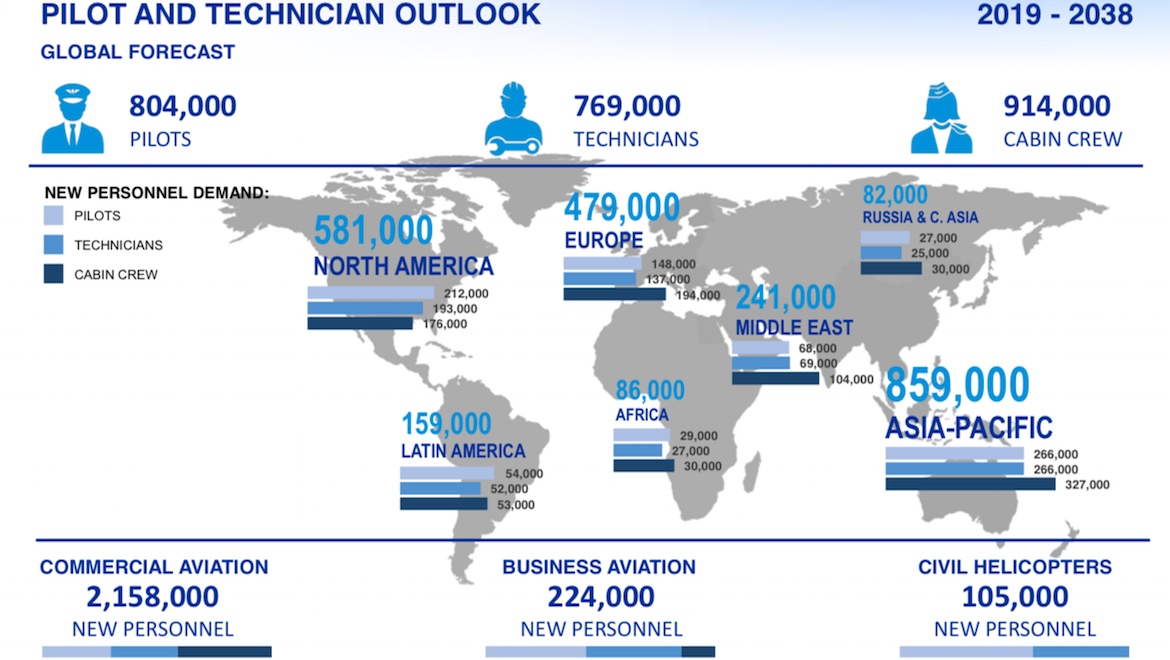

Meanwhile, some 2.49 million people will be needed to work in commercial aviation, according to Boeing’s Pilot and Technician Outlook, which said 804,000 new civil aviation pilots, 769,000 new maintenance technicians, and 914,000 new cabin crew would be needed to fly and maintain the world fleet over the next 20 years.

The forecast was inclusive of the commercial aviation, business aviation, and civil helicopter industries and was an increase from 790,000 pilots in the prior year’s outlook.

Demand for these employees will come from a mixture of growth of fleets and services, attrition and retirements.

For commercial aviation alone, Boeing forecast demand for 645,000 pilots, 632,000 technicians and 881,000 cabin crew.

“Meeting this strong demand will require a collective effort from across the global aviation industry,” Boeing said.

“As several hundred thousand pilots, technicians, and cabin crew reach retirement age over the next decade, educational outreach and career pathway programs will be essential to inspiring and recruiting the next generation of personnel.”

Crucially, training would also need to change.

“The aviation industry will need to adopt innovative training solutions to enable optimum learning and knowledge retention,” Boeing said.

“Immersive technologies, adaptive learning, schedule flexibility, and new teaching methods will be needed to effectively meet a wide range of learning styles. The growing diversity and mobility of aviation personnel will also require instructors to have cross-cultural, cross- generational, and multilingual skills to engage with tomorrow’s workforce.

“Effective training and an adequate supply of personnel will remain critical to maintaining the health and safety of the entire aviation ecosystem.”

John Walton is at Le Bourget all week — follow him live on Twitter at @thatjohn.