This week’s feature from the Australian Australian Archives comes from July 2009, when Ellis Taylor wrote about the arrival of Delta Air Lines to these shores a decade ago.

Following its ground breaking merger with Northwest Airlines in 2008, Delta Air Lines will become a truly global carrier with the start of its daily services to Sydney from July 1.

As Brian Swain, Delta’s managing director Asia explains, the Sydney services are a logical expansion for the airline, which is now the world’s largest airline by passenger numbers.

“With the merger with Northwest, we also became the number one US carrier to Asia,” Swain said.

“After the merger, if you look at our total network scope we were the number one US carrier within the US, to Africa, Europe and to Asia. So clearly Australia was the one area where we were missing network scope.”

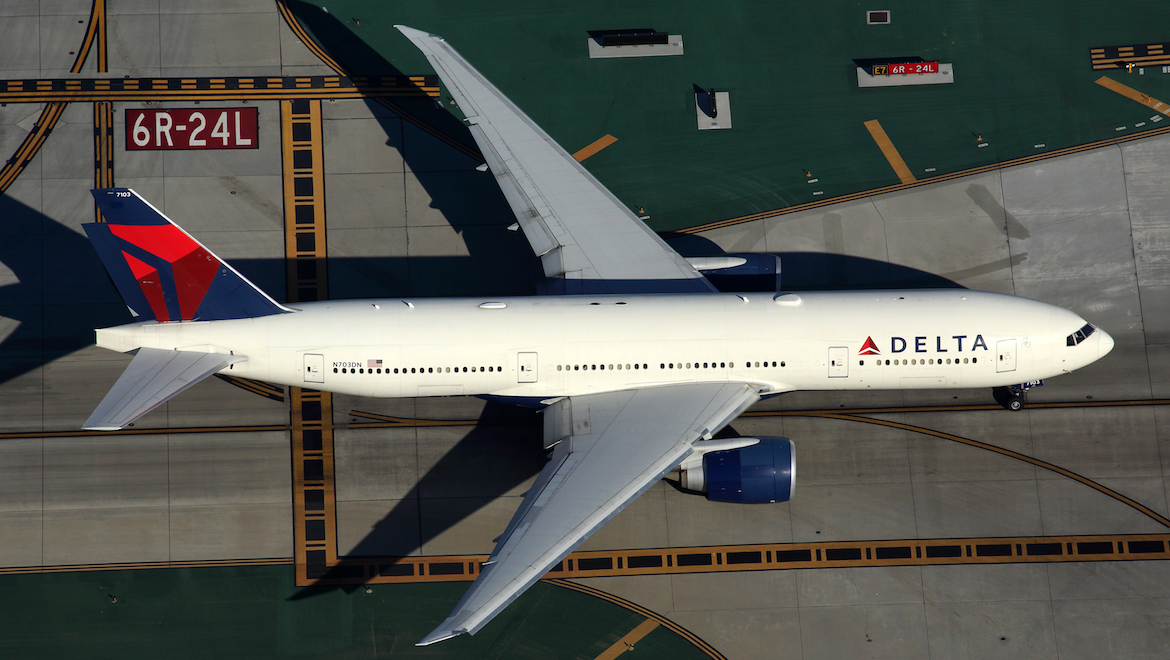

That led the carrier to announce in December 2008 that it would start a daily Atlanta-Los Angeles-Sydney service from July 1, flown by Boeing 777-200LRs, pitching it against Qantas’s A380, United’s 747-400 and V Australia’s 777-300ER services between Australia and the US.

The brand-new 777-200LRs which will operate the Sydney services (the first was only delivered in February 2008) carry 278 passengers, with 43 180-degree full-flat BusinessElite seats and 235 economy seats.

The BusinessElite seats are similar to Virgin Atlantic’s UpperClass seats, and offer a 193cm lie flat bed, arranged in a herringbone layout. The aircraft also feature audio and video on demand in all classes, making it comparable to the other airlines’ offerings on the route.

Interestingly, despite being competitors on the Australia-US market, both Delta and Virgin Blue have established a mutual interline agreement, which allows each carrier to ticket the other’s services and provides each carrier with complementary feed at both Sydney and Los Angeles.

This has led to some suggestions that this may evolve into a codeshare agreement between the two airlines to provide additional frequencies for passengers.

While Delta remains open to that, Swain says that the current focus of the relationship is merely on interlining.

“We are always open to further cooperation with other airlines. If that’s where that leads us, that’s what our customers want and it’s financially the right thing to do for Delta, then that’s where we would go. At this point we’re very comfortable with the interline connections.”

When Australian Aviation spoke to Steven Crowdey, Delta’s general manager for Australia, New Zealand and the Philippines, forward sales had been performing well despite the competition from the other carriers.

“We’re really pleased with them, they’re well above our expectations,” Crowdey said. “We were playing catch-up because we didn’t kick off sales much before February-March, but since then we’ve been very pleased with the results.”

Some commentators believe that a key to that success will be seeing United Airlines, which is generally perceived as the weakest of the four competitors, off the route, and capitalising on the large amount of US traffic it can bring in from its extensive network.

However, Swain says that this is not critical to its planning.

“We feel very comfortably that we can succeed whether United, Virgin or Qantas continue in the market,” Swain said.

“We’re very comfortable flying with four airlines. We’re used to flying in very competitive markets.”

The launch of Sydney services has been part of a growing Delta route network from Los Angeles. This has included increasing codesharing from LAX, with Delta also announcing in December an agreement with Alaska Airlines which provides for an increased number of connections from the Californian gateway. Alaska is also an interline partner with V Australia.

Longer term, it seems possible that the airline may try and expand its reach from Sydney to its main hubs in Atlanta and New York-JFK. Indeed, last year industry media reported that Delta had made an informal request to Boeing to seek ways to extend the range of the 777-200LR to allow it to operate nonstop flights from those two hubs.

As Swain says, getting passengers to those major hubs could work well, but would be dependent on having the right aircraft to operate it, which is currently not feasible.

“Obviously, there is the normal flow through Los Angeles and San Francisco. We feel that as the market continues to grow and we succeed on the LA flight, that will certainly open doors for us to expand into JFK and Atlanta. Obviously you need the right aircraft to do that.”

While declining to speak about the request to Boeing specifically, Swain added” “We’ll take it one step at a time and see where the aircraft capabilities develop from there.”

Speaking earlier this year, Virgin Blue chief executive Brett Godfrey had said that he believes the 777-300ERs operated by V Australia are more efficient than Delta’s -200LRs, as the larger aircraft have lower fixed costs and more revenue potential due to the extra seats and cargo capacity it offers. Nevertheless, Crowdey says that the -200LR is the right aircraft for its services.

“We have the ideal aeroplane for the route in the 777-200LR,” he said. “It’s not as though we’re trying to fill 450 seats and operate a high-cost aeroplane across the Pacific. We’re very confident in our ability to succeed.”

Merger and Fleet

While Delta’s launch of its Australian services is significant, as it will be the second US airline on the route, it is part of a much bigger expansion which the carrier has been undertaking both before and after its merger with Minneapolis-St Paul based Northwest, which received government approval in October 2008.

The merger has transformed Delta into a truly global airline, bringing together both carriers’ strengths in the US market (with Delta focused on the South and New York, and Northwest with its Midwest and Pacific-Northwest operations), as well as complementary global networks. The company said in its 2008 annual report that it expects to generate annual synergies of US$2 billion by 2012 from the merger.

As a result, the new Delta now operates a fleet of over 1,000 aircraft from five hubs in the US plus Tokyo and Amsterdam to 382 destinations in 74 countries, with over 75,000 staff around the world.

To bring all that together has been no small task, and has included dealing with a number of issues, including pilot seniority, branding, airports and many others. Nevertheless, Swain, who himself comes from the Northwest side of the company, says that the merger has been much faster and smoother than others in the industry.

“I’m very impressed by the speed of the integration as well as its continuity, and we haven’t hit many of the roadblocks other mergers have, particularly in the US,” Swain said.

So far major work on branding is being implemented, with the carriers consolidating most of their services in the US under the Delta brand, which is also being rolled out internationally. A number of Northwest aircraft have already been repainted in Delta colours, particularly those for international services.

Northwest is technically now a subsidiary of Delta, although that is expected to change soon.

“Key to the merger is combining operations under one operating certificate, which will allow Northwest to use Delta’s flight protocols,” said Swain. “From what I understand, that process, which is very complicated, is progressing well.”

A strategic part of the merger is Northwest’s significant presence in Asia. Due to the arrangements of the bilateral agreements between the US and Japan, Northwest is one of the biggest operators of flights to and from Japan. The carrier operates a hub from Tokyo which stretches its network from South Korea and China right through to Singapore and Guam, using both widebody and narrowbody aircraft.

The merger has also led to an interesting combination of the two airlines’ fleets, which have very little overlap. Delta has long been an operator of Boeing aircraft (at one stage it had a sole-source agreement with the manufacturer), while Northwest was one of the few US airlines to embrace Airbus and has built its fleet around the A320 Family and A330. Both also operate older types, such as Delta’s MDC MD-88s and Northwest’s sizable fleet of even older DC-9s.

While on the surface it would appear that the two fleets would have made integration difficult, there have been some major benefits to the combined Delta. Most notably, the addition of A330-200s and -300s as well as the 747-400 fleet has added more capacity options for Delta’s international services, which were primarily operated by 777-200s, 767-300ERs and 757s.

As a result, the company has seen some major benefits from having a variety of aircraft to operate on different routes.

“We started to really look at the entire fleet to right-size each route with the proper (aircraft),” said Swain.

“For example, on our Narita-Atlanta flight, Northwest came to the table with 747s and Delta’s largest aircraft was the 777. That flight was better sized for a 747 on that market and we’ve already been able to launch and swap aircraft between the two carriers.

“That’s actually a source of a lot of the synergies of the merger.”

Delta also has a strong order book, with 32 aircraft scheduled to enter service with the Delta this year and 23 the following year, ranging from Bombardier CRJ900s up to 777-200LRs. The company also has 194 aircraft on option, which includes 18 787s originally ordered by Northwest.

That 787 order has been the source of much speculation that Delta may cancel it due to the challenging economic environment and chronic delays to the program.

However, the airline’s president Ed Bastian told analysts in March that Delta “remains in serious discussions” with Boeing over the delivery schedule for the 787s, but has also said that it looks forward to taking delivery of the aircraft.

The 747s meanwhile will continue to serve as key long-haul aircraft for the foreseeable future, with no replacement planned soon.

Inevitably they may be supplemented and later replaced by more long haul twinjets longer term. Delta CEO Richard Anderson has regularly said that the airline has gained great benefit from its 777-200LR fleet, and it is expected that more aircraft above the eight it has committed to (five have already been delivered) may be acquired later on.

International Mover

Like other US airlines, Delta has been quick to take advantage of increasing liberalisation to broaden its reach, and is now the only US carrier to operate flights to six continents.

Like the other US legacy carriers, a key market for Delta is the Atlantic, which it first started serving in 1978 with flights between Atlanta and London/Gatwick. This was dramatically ramped up in 1991 after the airline purchased Pan Am’s trans-Atlantic routes following the collapse of that airline.

During most of the 2000s, Delta has expanded on this market by launching services on a number of thinner routes using internationally configured Boeing 757s, but has also pushed into London Heathrow, and built a significant presence at Paris Charles de Gaulle due to its strong relationship with Air France.

In May, the airline signed a new joint venture agreement with Air France-KLM. The new agreement effectively unifies the existing separate agreements between Northwest and KLM which commenced in 1997, and a similar 2007 agreement between Air France and Delta.

“The structure of this joint venture, in which we operate as a single business where we consensually develop our strategies and share revenues and costs, provides the incentives for us to collaborate in a way that generates benefits for customers, shareholders and employees of our three airlines,” said Anderson.

“Customers will benefit from the unique scope and choices we will offer, while shareholders and employees will benefit from the stronger competitive and financial position of our respective airlines.”

Interestingly, the joint venture, which has been valued at up to US$12bn (A$15bn), extends beyond trans-Atlantic services, covering the carrier’s combined services from Tahiti right across to the Indian subcontinent. That effectively ties in most of the international markets that Delta serves, and could mean a greater potential mix of passenger connections of all airlines involved in the agreement.

Delta was also a founding member of the Skyteam alliance, which includes Air France-KLM plus a number of other carriers such as Aeroflot, China Southern and Korean. Vietnam Airlines is also planning to join the alliance this year, while Malaysia Airlines is also expected to follow.

Unlike the Star and oneworld alliances, Skyteam has minimal exposure in the Australasian market, so the new Delta services will play a big part in lifting the alliance’s profile.

“I think Delta’s going to add enormously to that,” said Crowdey.

“We’ll have four carriers in there, and I think that’s a beachhead for improving the Skyteam offering in Australia and making it a competitive alliance down there.”

Other Business

As well as the main airline business, Delta also has a number of aviation related businesses to support the core airline.

One of the biggest is its maintenance, repair and overhaul business Delta TechOps. Although headquartered in Atlanta, the MRO has been growing steadily and has set its sights on becoming a larger player in this industry.

As well as maintaining the Delta fleet, TechOps also offers third-party services and has contracts with some Mexican carriers for maintenance.

One of the biggest changes for the business is the integration of Northwest’s engineering operations into TechOps. This has brought about new opportunities for the MRO, as its support for Northwest’s Airbus fleet adds more arrows to the company’s list of capabilities.

This is expected to be significant as it continues to grow the business.

Delta Cargo is also one of the biggest cargo carriers in the US, and relies both on using aircraft belly space and dedicated freighters. However, this business has been hit by the general slowdown in global cargo over recent months, and the company has taken the decision to ground most of its 747-200 freighters.

Challenging outlook

Despite all the good intentions of the company, Delta has not been immune to the tough times hitting the industry as a whole.

The airline recorded a loss in the fourth quarter of 2008 of US$340m (A$424m), which dragged its 2008 full year loss out to US$1.4bn (A$1.7bn). Nevertheless, the company said in a regulatory filing that it expects to be profitable in 2009.

Delta CEO Anderson has also announced that the company will make a 10 per cent capacity cut during the second half of the year, with most of the cuts to come on the Atlantic and Pacific. Swain says that this will be achieved primarily through changing aircraft capacity and frequency on some routes, rather than withdrawing from markets completely.

Interestingly, despite the cuts in capacity, Swain says that the airline still plans to roll out new destinations this year.

“Delta’s network view is not to pull down capacity just for the sake of pulling down capacity,” he said.

“We will pull down the capacity where we need to because demand is dropping off, but we will continue our expansion into markets where we feel they are ready to have Delta serve.”

The company’s size also gives it advantages at a tough time.

“The fact that we’re so large allows us to ride out the bad times better than some smaller carriers,” said Swain.

“We have a strong balance sheet and a lot of cash reserves. So we’re able to continue with our strategic plans because we’ve got enough weight behind us.”

Postscript: Delta Air Lines and V Australia (now Virgin Australia) received Australian Competition and Consumer Commission approval in 2009 and United States Department of Transportation approval in 2011 to establish an alliance on trans-Pacific routes.

VIDEO: A Network Ten news report from July 3 2009 covering Delta Air Lines’ inaugural Los Angeles-Sydney service from the jupjupz YouTube channel.

This story first appeared in the July 2009 edition of Australian Aviation. To reach more stories like this, become a member here.