Virgin Australia has tapped its four major shareholders for a $A425 million loan facility as part of a fresh review of its balance sheet.

The 12-month, $A425 million loan facility with Air New Zealand, Etihad Airways, Singapore Airlines (SIA) and Sir Richard Branson’s UK-based Virgin Group would provide the company with “additional flexibility in the short-term” as it conducts a capital structure review, Virgin said on Monday.

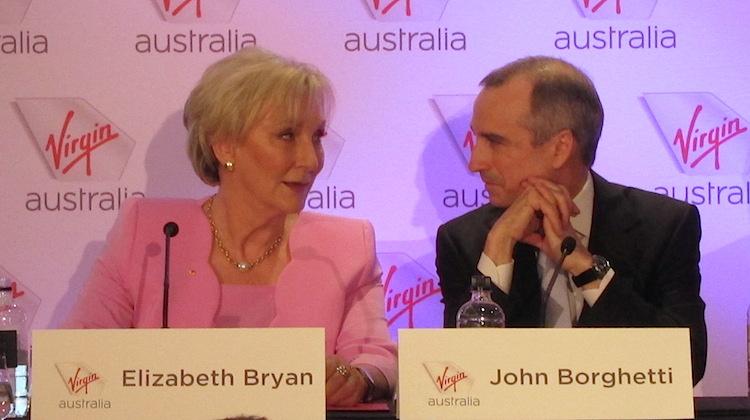

“The board is focused on optimising the group’s balance sheet and capital structure to support the ongoing execution of its strategy and will lead a capital structure review,” Virgin Australia chairman Elizabeth Bryan said in a statement.

“The group has secured loan facilities from its major shareholders that provide a flexible source of funding while the review is undertaken.

“This review will ensure the Virgin Australia group has the best capital structure in place to achieve its strategic goals and generate long-term growth and value for shareholders.”

Virgin said the loan facility was on “arm’s length commercial terms”, without providing further details.

It is not the first time Virgin has secured financial support from its major shareholders, with Air NZ, Etihad and SIA fully subscribing to a $A350 million capital raising in 2013. The capital raising also resulted in Air NZ, Etihad and SIA securing a seat on the Virgin Australia board. The trio also combined to provide a $A90 million loan to Virgin that year.

Virgin reported a welcome return to profitability in the 2015/16 first half with net profit coming in at $62.5 million, compared with a $47.8 million statutory net loss in the prior corresponding period, and is on track for a full year profit for the 12 months to June 30 2016.

However, analysts have raised some concerns about cashflow levels at the airline.

Virgin said the review would “include an assessment of the appropriate mix of debt and equity capital and operational initiatives to enhance cash flow and profitability”.

“Further details on the outcomes of the review will be provided in due course,” Virgin said.

Virgin chief executive John Borghetti said the airline was well placed to achieve ongoing growth.

“One of the key pillars of our Virgin Vision strategy is to optimise the group’s balance sheet, and the group has had an ongoing program in place to achieve this goal,” Borghetti said.

“Now is an appropriate time to embark on the next phase of this program by taking steps to ensure the group has a capital structure that supports its strategic objectives.”

The loan facility and capital review was greeted positively by the market, with Virgin shares up 2.5 cents, or 7.14 per cent, at 37.5 cents at the start of trade on the Australian Securities Exchange on Monday.