Qatar Airways has improved passenger numbers and average load factors on its new Adelaide-Doha service in June, after the route got off to a slow start in May, official figures show.

Figures from the Bureau of Infrastructure, Transport and Regional Economics (BITRE) showed there were plenty of spare seats for passengers during the first month of Qatar Airways’ daily Adelaide-Doha flights, which began in early May.

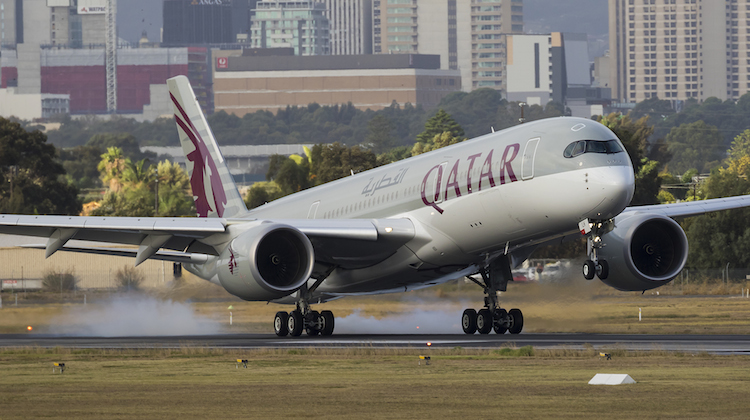

An analysis of the monthly BITRE report and flight tracking data shows Qatar carried 1,728 passengers on its inbound Doha to Adelaide flights in the month of May. Given the oneworld alliance member operated 30 flights on the route in May and its A350-900s were configured with 283 seats (36 business and 247 economy), that translated to an average load factor of 20.4 per cent.

The reciprocal Adelaide-Doha service fared better, with 4,825 passengers carried for an average load factor of 56.8 per cent.

There was an improvement in June, however, with the BITRE figures showing Qatar flew 3,034 passengers to Adelaide for an average load factor of 35.7 per cent, while there were 6,045 passengers on the outbound Adelaide-Doha flight, which translated into an average load factor of 71.2 per cent.

Adelaide became the fourth Australian port for Qatar alongside Melbourne, Perth and Sydney, which kicked off in March 2016.

The improvement on the Adelaide route, Australia’s first scheduled A350 passenger service, in June helped lift Qatar’s overall load factors in June to 60.5 per cent inbound and 89.1 per cent outbound, compared with 48.9 per cent and 83.8 per cent, respectively, in May.

Qatar had offered very attractive promotional fares for its Adelaide service prior to its launch, with the airline’s chief executive Akbar Al Baker telling reporters after the inaugural flight touched down he expected yields to improve and fares to rise once the route was more established.

Also, Al Baker told The Australian he was committed to Adelaide even if the route didn’t turn a profit.

“In our industry, it’s not always profit from a destination. We are a network carrier and we always look at the network contribution,” Al Baker told the newspaper.

“We wouldn’t be coming here if there was no network contribution.

“Any new route will lose in the first year or two, but airlines should always be prepared when they are growing to lose.

“We invest in new routes and this is an investment for the growth of Qatar networks as a network carrier. Qatar Airways never withdraws from a market as long as we have a positive network contribution.

“We always come to a destination to stay long term.”

Qatar planned to reduce its daily Adelaide flights to five times a week between late October 2016 and March 2017.

Speaking on the sidelines of the recent CAPA – Centre for Aviation Australia Pacific Aviation summit in Brisbane, Qatar Airways senior vice president for aeropolitical and corporate affairs Fathi Atti declined to comment specifically on the commercial performance of the route.

However, Atti noted that all new routes took a period of time to ramp up and he expressed confidence Adelaide would perform well for the airline.

Meanwhile, Qatar’s regional rivals Etihad Airways and Emirates Airline have also suffered a drop in average load factors over the past year.

Emitates’ services to Australia had an average load factor of 63.8 per cent in June, while it was 76 per cent for the Qantas alliance partner’s outbound flights from this country, the BITRE figures showed. This compared with 70.8 per cent inbound and 80.4 per cent outbound in June 2015.

Etihad’s flights to Brisbane, Melbourne, Perth and Sydney from its Abu Dhabi hub were 56.6 per cent full in June 2016, the BITRE report said, down from 70 per cent in the same month a year earlier, while average load factors on its outbound flights were at 84.5 per cent, compared with 95.6 per cent in June 2015.

The figures highlighted the competitive nature of the international travel market, particularly for flights to Europe through mid-point hubs in Asia and the Middle East as airlines added new capacity and launched new routes. Figures from earlier in 2016 suggested airfares in Australia were at multi-decade lows.

As an example, Virgin Australia shareholder and alliance partner Etihad recently had a $999 sale fare for flights from its four Australian ports to Abu Dhabi, while Skyteam alliance member Vietnam Airlines offered return fares to Europe for less than $1,000.

Book a flight to Abu Dhabi with Etihad cause they’re only $999 return

Melbourne or Sydney, Australia to Paris, France from only $919 AUD roundtrip.https://t.co/5cOumjBj9s pic.twitter.com/yv7XXZoqxd

— Secret Flying (@SecretFlying) September 3, 2016