Air New Zealand chief executive Christopher Luxon was in a New York state of mind when announcing the airline’s new wide-body fleet of Boeing 787-10s in Auckland on Monday.

Luxon says the new aircraft are capable of flying direct from Auckland to New York, a distance of 7,671nm according to the Great Circle Mapper. The carrier has its eyes on the route as soon as it can work through arrangements with its joint-venture partner on the New Zealand-US market, United Airlines.

While Luxon wouldn’t be pinned on a date, he said the airline had one in mind. When asked if it could be around 2022 or 2023, he said it could be.

Further, using a cabin configuration with fewer seats, it could fly to New York or other eastern ports earlier than this timeframe with its current 787-9 aircraft.

Luxon said it was too early to give particulars such the date and choice of airport. United mostly flies out of New York from Newark Airport, located in New Jersey.

Air New Zealand has been focused on the premium passenger market and New York would be no exception, Luxon said, citing value over volume as a driver for the New Zealand tourism market.

“We don’t want to become a Cancun or a Bali but a Switzerland,” Luxon told reporters in Auckland after the offical announcement of the 787-10 order on Monday.

He said Air New Zealand and its partners were rather unique because they brought 45 per cent of all visitors to New Zealand.

“No other airline in the world would have that market share or responsibility for those visitors,” he said.

“When those visitors are here we want them spending a lot each day in our tourism sector and that is how we get the productivity and value of our tourism up so we want a high-value customer in that seat.”

He said possibilities for the new 787-10s could involve doing more of what it had done with the 787-9, which have two different cabin layouts, comprising an initial 302-seat variant and a 275-seat that was introduced later with more premium economy and business class seats in what Air New Zealand has called its “Code Two” configuration.

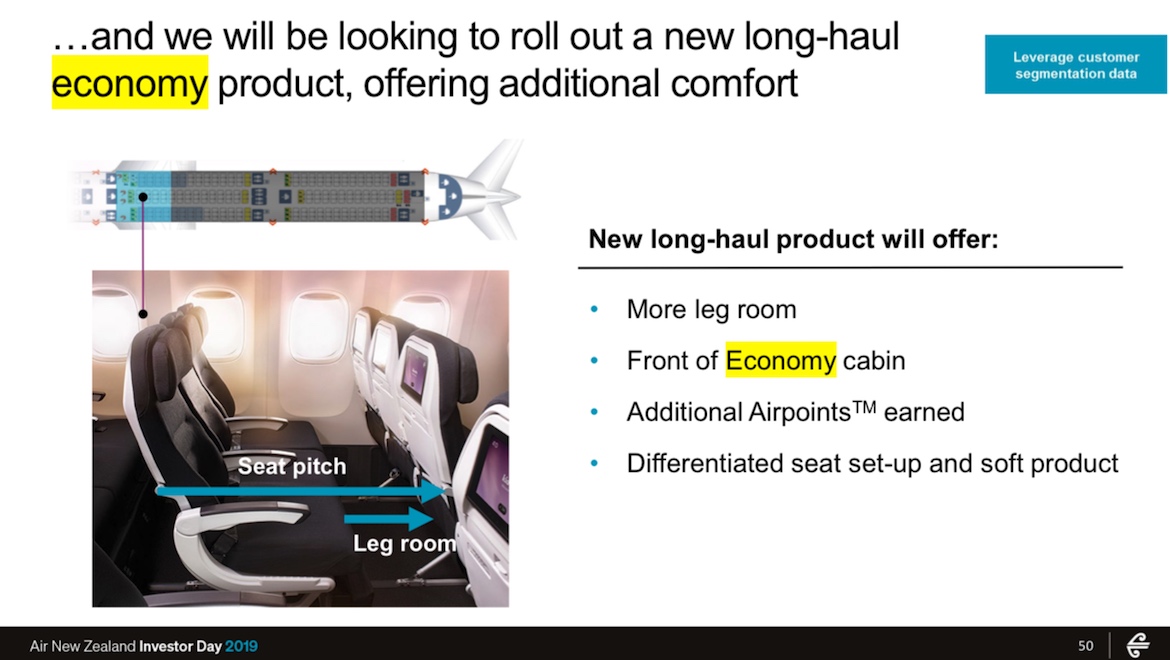

Luxon said the airline would also be bringing a new economy plus type product into its aircraft in the middle of 2020.

“We just want to make sure we have massive flexibility and consistent product. Then we just send our planes to where we need to where the economics work,” Luxon said.

He said using a 777-200ER for the Shanghai route was a classic example having an aircraft that was too heavy and too big when it first started flying there in 2006. Air New Zealand replaced it with a Boeing 767-300ER that flew at full capacity, but with low-value group travellers from China.

Now, with a 787-9 on the route, Luxon said the airline had found in a space of three to five years it needed more premium seats for higher net worth individuals, as opposed to corporates.

It was an experience that would help inform any nonstop Auckland-New York operation.

“If you can find the right customer out of New York that is the way we want to go,” he said.

“We know that as markets develop, Argentina is more students and leisure travel but we are seeing already that as more people do business [between the two countries] the mix starts to change.”

Why Boeing?

The announcement of a letter of intent to buy eight 787-10 Dreamliners to replace eight 777-200ERs comes five years to the day since the airline took delivery of its first 787-9.

There is also an option for the airline to buy a further 12 787-10s or -9s, as well as having the ability to switch between the larger 787-10 and the 787-9.

Luxon said recent criticism faced by Boeing for the way it had done business, particularly after the crashes of two Boeing 737 MAX aircraft, had given Air New Zealand no reason to pause for thought.

He said the airline had known Boeing for more than 50 years, adding it was comfortable doing business with both Boeing and Airbus. It knew both from “top to top”.

“The specific issue around the MAX is the MCAS (Manouvering Characteristics Augmentation System) and it is a completely different aircraft,” he said.

“There is nothing similar available in the 787 family and the 787 is now a well-established platform.

“If you zoom out you have gone from a world where every 25 years you get these big innovation breakthroughs that seem to come in aviation and then things settle down.

“Now we have gone to these two-engine carbon fibre planes and it has required new airframe and engine development.

“And then there is the demand of 170-odd airlines saying to Boeing and Airbus that we want more fuel-efficient aircraft so then they go and push three engine manufacturers to deliver those engines. There is quite a lot of new innovation coming through and it partly needs to be settled down and commissioned and stabilised as we work our way through it.”

Luxon said the orders and options for the new Dreamliners had been negotiated around both pricing and flexibility, with Baden Smith, Air New Zealand’s head of fleet strategy and transactions, doing “some complex and tough negotiation”.

“It’s always complex because so many airlines get those decisions wrong and they miss out for 20 years in participating,” he said.

“It was a lot of that flexibility that was a big part of the focus and making sure that we get that decision right for us.”

The deal is a package with purchases, options and substitution rights that can be tailored for a changing economic climate and growth opportunities.

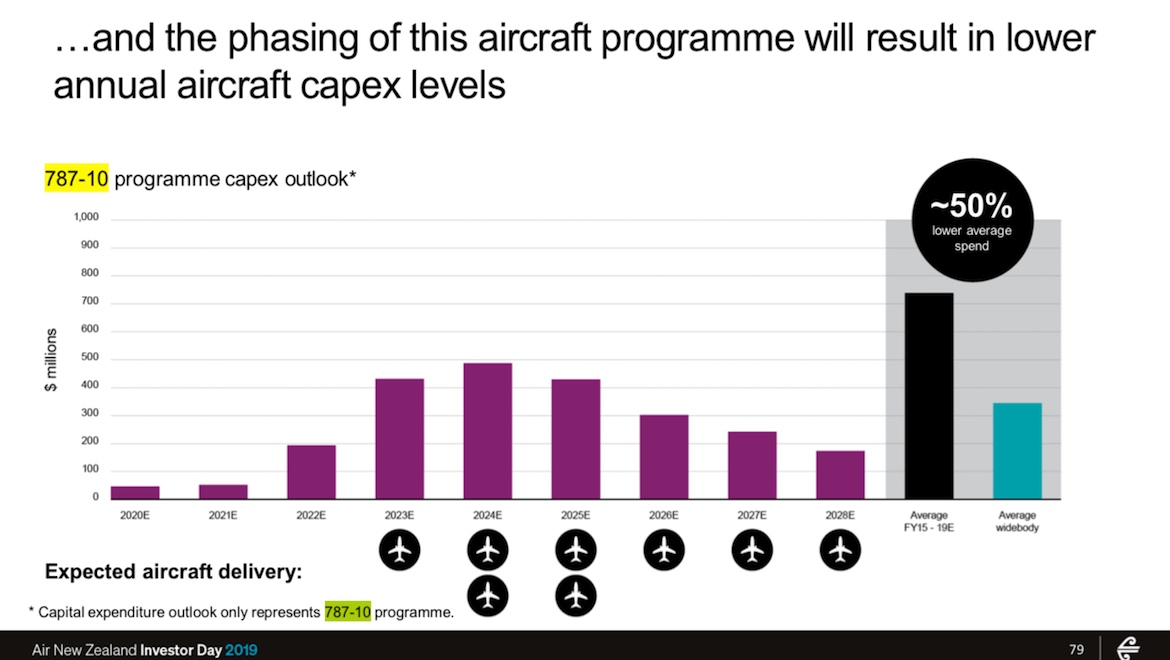

The aircraft would be delivered from 2022 to 2027, with each of the eight 777-200ERs being phased out upon arrival as each new plane arrived.

The airline said recently that a slowing global economy had changed its growth prospects in the next three years from a forecast five to seven per cent to a more moderate three to five per cent.

Luxon said the airline was “in superb financial shape” and was fortunate that it had massive cash reserves, a great credit rating and good levels of gearing to negotiate for the new fleet.

“This is very digestible for us” he said.

“We have still committed to the same number of aircraft but are just taking them at a slightly slower rate by two years, purely so we can match our growth to our capital expenditure as we see lower levels of growth coming through.”

That slower rate would free up NZ$750 million in cashflow.

“In my experience airlines don’t often match up the supply and demand very well,” he said.

“They don’t face up to their reality in the year and make the necessary adjustments and all of that gets accumulated over a period of time, then you are left with some uglier choices you have to make down the road.”

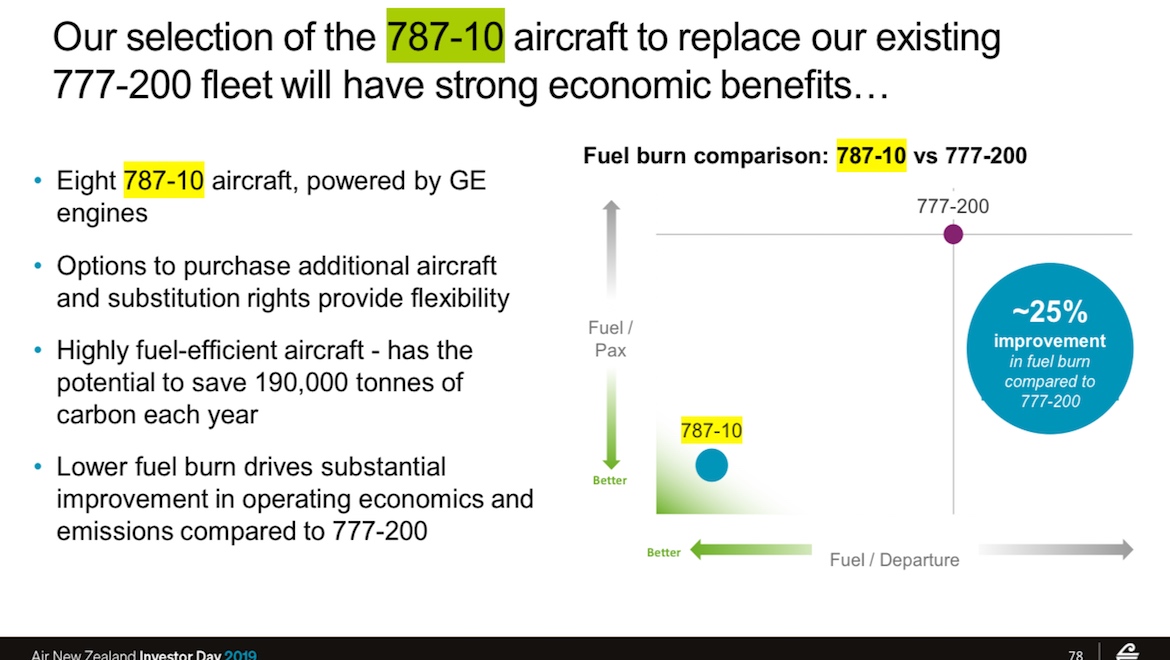

Luxon said Air New Zealand chose Boeing because of a combination of things.

“We started looking at the route mix we had as well as the passenger mix, which is often different from other airlines,” Luxon explained.

“We spoke to lots of airlines about their choices but for us we thought this was a good scenario. We felt the 787-10 gave us the flexibility to do what we wanted to do.”

On the decision to opt for GE Aviation rather than Rolls-Royce engines – which are on the existing 787-9 fleet – Luxon said the GEnx-1B powerplant gave Air New Zealand “that little bit more fuel efficiency, which actually helped us getting us to where we wanted to get to and that is really one of the things we weighed up in the end”.

Luxon reiterated that its recent grounding of aircraft because of problems with the Rolls-Royce Trent engines had nothing to do with the airline’s decision to opt for GE.

He said the airline had a good relationship with Rolls-Royce and its engines would remain in its present fleet of 13 787-9 aircraft and the 14th due for delivery later in 2019.

Luxon said the 25 per cent improvement in fuel burn efficiency of the 787-10 compared with the 777-200ER was helpful, as was the carbon sustainability and the benefits of the customer experience that could be built into the aircraft with a reinvention of the interiors.

Once the new interior was revealed in the first 787-10 in 2022, Luxon said the same cabin profile would be introduced to all of its wide-body aircraft.

“We want to make sure we have a consistent wide-body fleet. We are one of the few airlines where it doesn’t matter whether you are travelling on a 787 or a -9 or a -10; it is the same product,” Luxon said.

He said the challenge now with the fleet decision out of the way was to get the seat configuration right, describing it as the “holy grail” of the business.

The 787-10 had around 15 per cent more space for passengers and cargo.

“With weight around cargo, fuel and passengers we think there there is an opportunity to move to a more premium product,” he said.

777-300ER replacement

Luxon said replacing the question of what will replace the airline’s seven 777-300ERs was a separate decision from the options on the 787-10.

“We’ve actually compartmentalised those decisions so our view at this point is that we would still need a replacement for the 777-300ER,” he said.

“Our intention at this stage is when the 777-300s come up for replacement towards the mid-to-late 2020s, that would be the logical time when we will probably want to look at a larger aircraft – the A350s and the Boeing 777Xs come into the frame.

“At this point the 787-10s [or nines] are not code for replacing the 300’s.

“We are really impressed with the candidate aircraft [to replace them]. The A350-1000 is a great aircraft, as is the Boeing 777X, though it still has to come through development.”