Australia’s International Air Services Commission (IASC) has knocked back Qantas’s application to forge a deeper codeshare arrangement with Cathay Pacific.

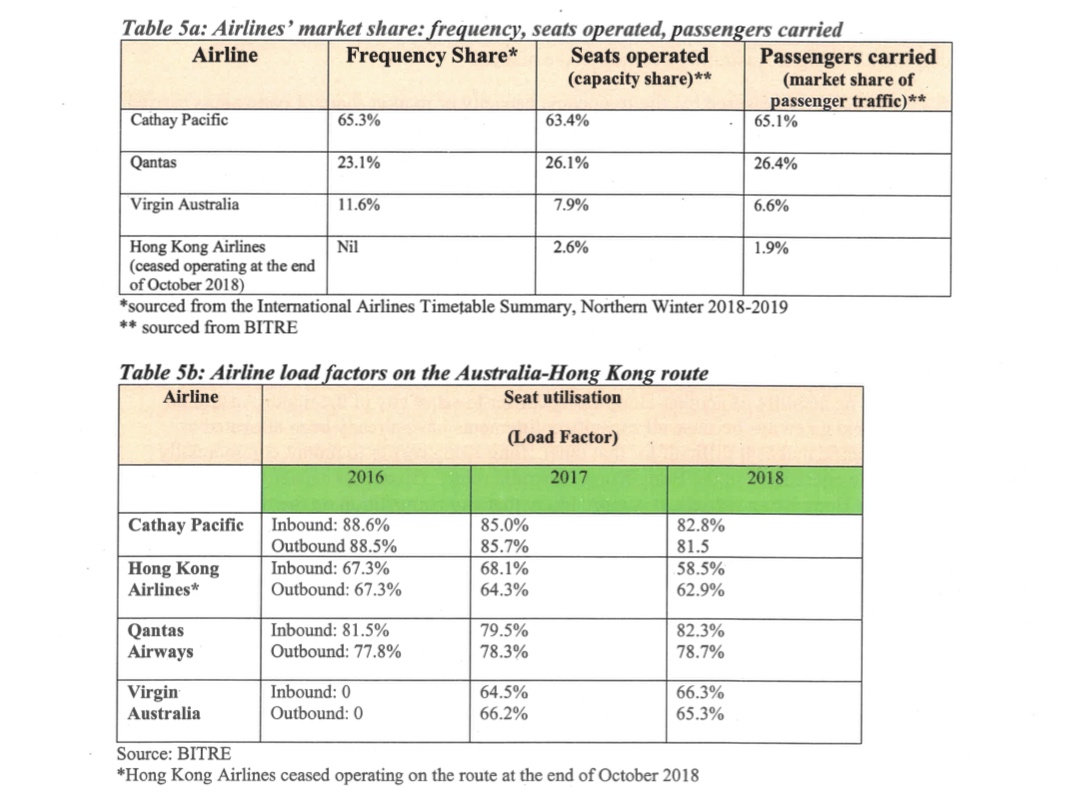

In a draft ruling published on May 24, the IASC said the proposed codeshare arrangement on flights between Australia and Hong Kong was likely to “entrench and expand the market position of Qantas and Cathay Pacific, to the detriment of Virgin Australia’s competitive position and the position of any potential future entrants on the route”.

“If this occurs, it is likely to weaken competition on the route, leading to an increase in prices and/or a reduction in other benefits to consumers,” the IASC draft decision said.

“The Commission finds that the likely public benefits of the variation are substantially outweighed by the likely public detriment that would follow from the proposed aviation.”

In early 2019, Qantas sought regulatory approval for Cathay Pacific to add its CX airline code on 35 Qantas-operated flights a week from Brisbane, Melbourne and Sydney to Hong Kong.

The codeshare flights on these routes would only be sold as part of a through journey involving connections either beyond Hong Kong on Cathay Pacific or its regional wing Cathay Dragon to destinations in India, Sri Lanka and Vietnam, among other countries, or to other Australian domestic destinations from Brisbane, Melbourne and Sydney on Qantas.

Qantas also planned to add its QF airline code on 35 Cathay Pacific-operated flights a week from the same three Australian cities and Hong Kong. However, this did not require regulatory approval.

The proposed codeshare expanded on an existing arrangement that has been in place since late 2018, where Qantas added its QF airline code on selected Cathay Pacific/Cathay Dragon flights out of Hong Kong – as well as on Perth-Hong Kong and Cairns-Hong Kong, and Cathay Pacific added its CX airline code on selected Qantas Australian domestic flights.

The Australian carrier said in its submissions to the IASC the expanded codeshare covering Brisbane, Melbourne and Sydney to Hong Kong would have no adverse impact on the competitive dynamics on point-to-point routes between Australia and Hong Kong.

Rather, it was was focused on attracting connecting passengers and a “a pro-competitive expansion of each carrier’s ability to sell and market itineraries”.

However, the application was opposed by Virgin Australia, the only other airline offering nonstop passenger flights between Australia and Hong Kong.

In its submission to the IASC, Virgin Australia rejected Qantas’s assertion there would be no adverse impact on the competitive dynamics on point-to-point routes between Australia and Hong Kong.

Instead, giving Cathay Pacific the ability to sell Qantas-operated flights under the codeshare agreement – even if it was only for connecting itineraries – was likely to lead to higher passenger load factors on Qantas’s flights between Australia and Hong Kong.

This would give Qantas a greater ability to adopt different strategies on pricing and inventory management and result in a potentially significant detrimental impact on competition, Virgin Australia said.

The IASC draft decision said the proposed codeshare was likely to lead to a market structure which made it more difficult for Virgin Australia to compete, as well as raise the barriers for new entrants on the route.

“It is likely Virgin will have a weakened, and perhaps materially weakened, position that may make it difficult for Virgin to sustain its operations,” the IASC draft decision said.

“The commission considers it likely that a material decline in Virgin Australia’s market position would cause it to reconsider its service offerings on the route.

“Any reduction or cessation of Virgin Australia’s service offerings on the route would be detrimental to competition as it would then leave the two largest carriers, Qantas and Cathay Pacific, to operate under the proposed code share arrangement.”

Qantas said in a statement it was reviewing the decision and considering its next steps.

“We’re disappointed with the draft decision to reject our application to expand our codeshare with Cathay Pacific,” a Qantas spokesperson said in an emailed statement to Australian Aviation.

“The codeshare has already delivered great benefits for our customers and expanding it would create even more options for travellers and improve opportunities for frequent flyers.”

Cathay Pacific, Qantas and Virgin Australia the only three airlines with nonstop Australia-Hong Kong flights

Currently, Cathay Pacific serves six destinations in Australia – Adelaide, Brisbane, Cairns, Melbourne, Perth and Sydney – from its Hong Kong hub with a mix of Airbus A330-300s, A350-900s and Boeing 777-300ERs offering business, premium economy and economy. This does not include freighter services. Cairns flights are ending in October.

It is the only Hong Kong-based carrier offering nonstop flights to Australia, after Virgin Australia alliance partner Hong Kong Airlines withdrew its flights to Cairns and the Gold Coast in October 2018.

Qantas offers nonstop flights from Brisbane, Melbourne and Sydney to Hong Kong with a mix of Airbus A330s, A380s and Boeing 747s and 787-9s.

Virgin Australia started serving the Special Administrative Region (SAR) with its own aircraft in July 2017, when it began nonstop flights on the Melbourne-Hong Kong route with two-class Airbus A330-200s.

It added daily Sydney-Hong Kong services, again with A330-200 equipment, in July 2018.

Submissions in response to the IASC draft decision were due by June 7.

The full draft decision can be read on the IASC website.

The proposed codeshare flights are shown in bold in the table below:

Flight Number/Routing |

Qantas flights |

Cathay Pacific flights |

|

Brisbane-Hong Kong |

QF97 10:10–17:25 |

CX156 00:55 – 07:30 |

|

Hong Kong-Brisbane |

QF98 20:15 – 07:00+1 |

CX157 13:10 – 23:35 |

|

Melbourne-Hong Kong |

QF29 09:40 – 17:20 |

CX134 07:30 – 15:05 |

|

Hong Kong-Melbourne |

QF30 20:10 – 07:35+1 |

CX105 00:10 – 11:10 |

|

Sydney-Hong Kong |

QF127 10:20 – 18:00 |

CX110 07:35 – 15:20 |

|

Hong Kong-Sydney |

QF128 19:30 – 06:55+1 |

CX139 09:10 – 20:20 |

Source: Qantas