Qantas will seek to reverse a draft ruling from Australian regulators denying the airline approval to allow Cathay Pacific to codeshare on flights between Australia and Hong Kong.

Australia’s International Air Services Commission (IASC), which manages the nation’s traffic rights, said on May 24 it planned to knock back Qantas’s request to forge a deeper codeshare agreement with Hong Kong-based Cathay Pacific.

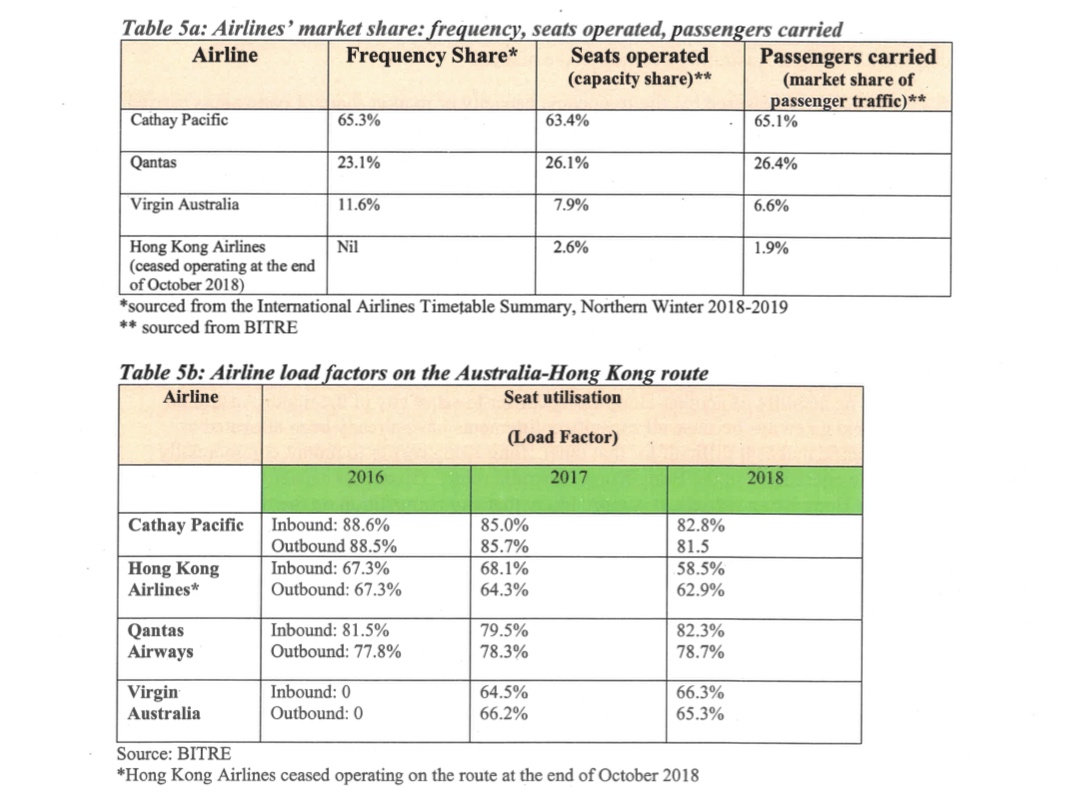

The draft ruling argued allowing Cathay Pacific to add its CX airline code on 35 Qantas-operated return flights a week from Brisbane, Melbourne and Sydney to Hong Kong was likely to “entrench and expand the market position” of the two airlines to the detriment of Virgin Australia’s competitive position and the position of any potential future entrants on the route.

“If this occurs, it is likely to weaken competition on the route, leading to an increase in prices and/or a reduction in other benefits to consumers,” the IASC draft decision said.

“The Commission finds that the likely public benefits of the variation are substantially outweighed by the likely public detriment that would follow from the proposed aviation.”

The codeshare flights would only be sold as part of a through journey involving connections either beyond Hong Kong on Cathay Pacific or its regional wing Cathay Dragon to destinations in India, Sri Lanka and Vietnam, among other countries, or to other Australian domestic destinations from Brisbane, Melbourne and Sydney on Qantas.

The airline had argued the codeshare agreement was a pro-competitive move designed to offer passengers more choice on a greater number of city pairs and have no adverse impact on the competitive dynamics on point-to-point routes between Australia and Hong Kong.

However, the IASC disagreed, saying in its draft decision the proposed codeshare was likely to lead to a market structure which made it more difficult for Virgin Australia to compete, as well as raise the barriers for new entrants on the route.

“It is likely Virgin will have a weakened, and perhaps materially weakened, position that may make it difficult for Virgin to sustain its operations,” the IASC draft decision said.

“The commission considers it likely that a material decline in Virgin Australia’s market position would cause it to reconsider its service offerings on the route.

“Any reduction or cessation of Virgin Australia’s service offerings on the route would be detrimental to competition as it would then leave the two largest carriers, Qantas and Cathay Pacific, to operate under the proposed code share arrangement.”

Qantas group chief executive Alan Joyce said the IASC got it wrong.

“We don’t think that is a good decision,” Joyce told reporters on the sidelines of the International Air Transport Association (IATA) annual general meeting in on Seoul on Monday.

“We are actually going to appeal it.”

Joyce said the claimed public benefits Qantas put before the IASC had not been fully evaluated.

“We will go back to the IASC and make sure we are very clear on what we believe those public benefits are,” Joyce said.

Cathay Pacific and Qantas started codesharing in 2018

The two carriers began codesharing in October 2018, with Qantas adding its QF airline code on Cathay Pacific-operated Perth-Hong Kong and Cairns-Hong Kong flights, as well on 10 routes from Hong Kong to destinations in India, Myanmar, Sri Lanka and Vietnam.

In turn, Cathay Pacific added its CX airline code on select Qantas domestic services from Adelaide, Brisbane, Cairns, Melbourne, Perth and Sydney.

Then, in early 2019, the pair sought to expand the partnership to include each other’s flights from Brisbane, Melbourne and Sydney to Hong Kong.

In addition to the application to the IASC for Cathay Pacific to codeshare on Qantas’s flights on those three routes, Qantas too planned to codeshare on 35 Cathay Pacific-operated flights a week from the same three Australian cities and Hong Kong. However, this did not require regulatory approval.

Cathay Pacific and Qantas dominate the Australia-Hong Kong market with close to 90 per cent market share in terms of seats.

Virgin Australia, with its daily nonstop flights from Melbourne and Sydney to Hong Kong with Airbus A330-200 equipment, is the only other operator in the market. It had vigorously opposed the application.

Meanwhile, the waiting goes on for decision on American Airlines-Qantas JV

Joyce also expressed hope that the United States Department Transportation (DOT) would soon come to a decision on the proposed joint-business agreement between American Airlines and Qantas.

The application, which was submitted in February 2018, sought anti-trust immunity (ATI) for an expanded alliance and joint-business agreement on trans-Pacific routes.

It was the pair’s second attempt to forge a closer relationship, after the DOT in November 2016 denied the initial application that was lodged in 2015.

“We think we are making good progress,” Joyce said.

“American Airlines do believe that good progress is being made with the regulator over there.

“They have to take the appropriate time to do it. They’ve had a lot on with the other issues that have occurred in the US with the Department of Transport.”

The two carriers have said in submissions to the DOT the proposed joint business agreement would generate an estimated $310 million annually in incremental consumer benefits should it be approved.

However, being prevented from having deeper partnership would place at risk some trans-Pacific flights, such as Qantas’s Sydney-Dallas/Fort Worth and American’s Los Angeles-Sydney and Los Angeles-Auckland services.

Joyce said Qantas and American Airlines had committed to launch new routes if the proposed alliance was given the green light.

“I think we’ve committed to three new routes, so we will probably do a couple, American Airlines one, immediately,” Joyce said.

“We’ve said before it possibly would be Brisbane to Chicago, Brisbane to Seattle or Brisbane to Dallas as a new route. We haven’t finalised it and do we want to save something when we get ATI.”

“We have a number of different ideas of very good routes and very good expansion into the US if it is approved.”

Qantas has eight Boeing 787-9s in its fleet, with a further six on firm order. The airline group, which includes low-cost carrier (LCC) Jetstar, also holds about 35 options and purchase rights for the Dreamliner that can be used for any of the three variants the 787-8, 787-9 and 787-10.

“We have the planes to be able to do it,” Joyce said of the potential US expansion.

“Some of the 787 orders that we have we can direct to the States in order for us to grow.”

India: as one door closes . . .

In other Qantas network news, Joyce said the airline was in talks with a number of Indian carriers for a new partner in the country following the collapse of Jet Airways.

“With Jet going under we have seen a loss of feed. They were a big partner and we were carrying a lot of traffic on them,” Joyce said.

“We have been approached by just about every major Indian carrier because they know that and they know that there is a lot of traffic that we can put on them.

“We’ve had dialogue in the last few days with four different carriers for possible agreements with them. We are just looking and exploring all of our options and seeing what’s the best one to be implementing.”