Defence contractor Raytheon and aerospace supplier United Technologies have announced plans to merge, creating a mega company with annual sales of about US$74 billion.

The two firms said in a joint statement on Sunday (US time) the new company, to be called Raytheon Technologies, would create a premier systems provider with advanced technologies to address rapidly growing segments within the aerospace and defence industries.

“Today is an exciting and transformational day for our companies, and one that brings with it tremendous opportunity for our future success,” Raytheon chief executive Tom Kennedy said in the statement.

“Raytheon Technologies will continue a legacy of innovation with an expanded aerospace and defense portfolio supported by the world’s most dedicated workforce.

“With our enhanced capabilities, we will deliver value to our customers by anticipating and addressing their most complex challenges, while delivering significant value to shareowners.”

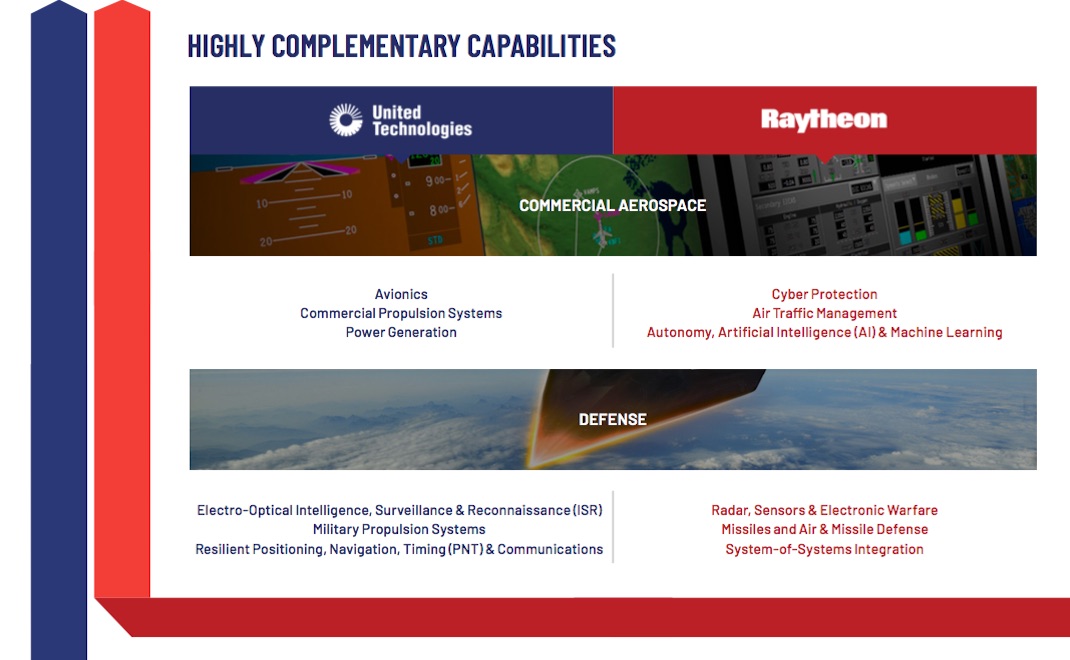

Raytheon’s defence work includes making radars, sensors and weapons such as missiles. It also conducts defence systems integration and has a space and airborne systems division. The company also does some work in the commercial aerospace sector, such as in air traffic control and autonomy, artificial intelligence and machine learning.

Meanwhile United Technologies two main businesses are engine maker Pratt & Whitney and Collins Aerospace, which manufactures equipment for commercial, regional and military aircraft such as seats, landing gears and sensors.

The transaction does not include United Technologies’ elevator company Otis and its refrigeration business Carrier, which were being sold off.

“The combination of United Technologies and Raytheon will define the future of aerospace and defense,” United Technologies chief executive Greg Hayes said.

“Our two companies have iconic brands that share a long history of innovation, customer focus and proven execution.

“By joining forces, we will have unsurpassed technology and expanded R&D capabilities that will allow us to invest through business cycles and address our customers’ highest priorities.

“Merging our portfolios will also deliver cost and revenue synergies that will create long-term value for our customers and shareowners.”

The joint statement said the merged company would comprise a balanced and diversified aerospace and defence portfolio that was resilient across business cycles.

Further, the two companies had a highly complimentary technology and research and development platform.

The new company, which will be led by Kennedy as executive chairman and Hayes as chief executive, would have four business units.

Two are from United Technologies, comprising Collins Aerospace and Pratt & Whitney, while two would be from Raytheon – intelligence, space & airborne systems, and integrated defense & missile systems.

The all-stock deal was expected to close in the first half of calendar 2020.

Raytheon shareowners would receive 2.3348 shares in the combined company for each Raytheon share. Meanwhile United Technologies shareowners would own about 57 per cent and Raytheon shareowners would own approximately 43 per cent of the combined company on a fully diluted basis.

The combined company’s board would have 15 directors – eight from United Technologies and seven from Raytheon.

In an Australian context, Raytheon supplies sensors, effectors, electronic warfare and mission systems to various Australian Defence Force platforms.

In 2017, it opened a customer engagement centre in Canberra.

Meanwhile, Collins Aerospace, formerly known as Rockwell Collins, had about 50 employees in Australia and builds parts of the F-35 Distributed Aperture System (DAS) optical assemblies for prime contractor Northrop Grumman.

More broadly, the company manufacturers avionics, navigation and communications equipment for defence and commercial customers. Its Sydney base offers technical support for repair, overhaul and equipment modifications for its own products as well as those from other companies.

And Virgin Australia’s business class seats on its five Boeing 777-300ERs and six Airbus A330-200s are from B/E Aerospace, which was purchased by Rockwell Collins in 2017 and is now part of the Collins Aerospace group of companies.