Airbus has raised its forecasts for new aircraft deliveries over the next 20 years amid a growing middle class across the globe and as airlines sought to replace older generation aircraft with more fuel efficient models.

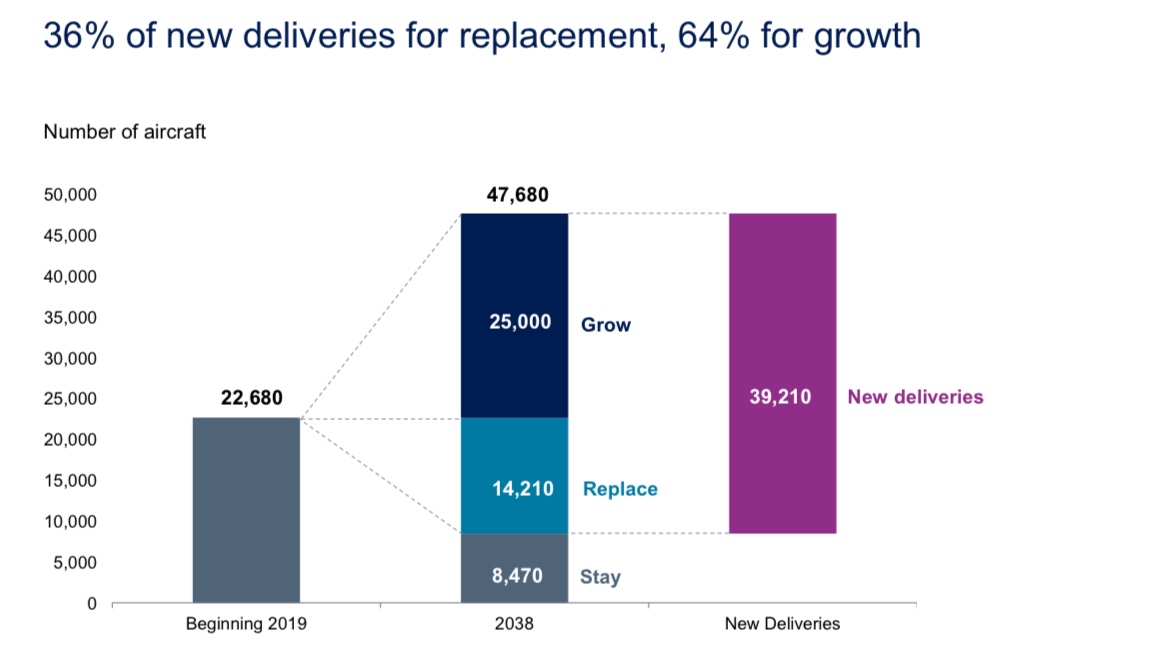

The Airbus 2019-2038 Global Market Forecast (GMF) published on Wednesday (European time) said airlines were expected to order 39,210 new aircraft with more than 100 seats between now and 2038.

The figure is up 4.9 per cent from the 37,389 expected new aircraft deliveries in the 2018-2037 GMF.

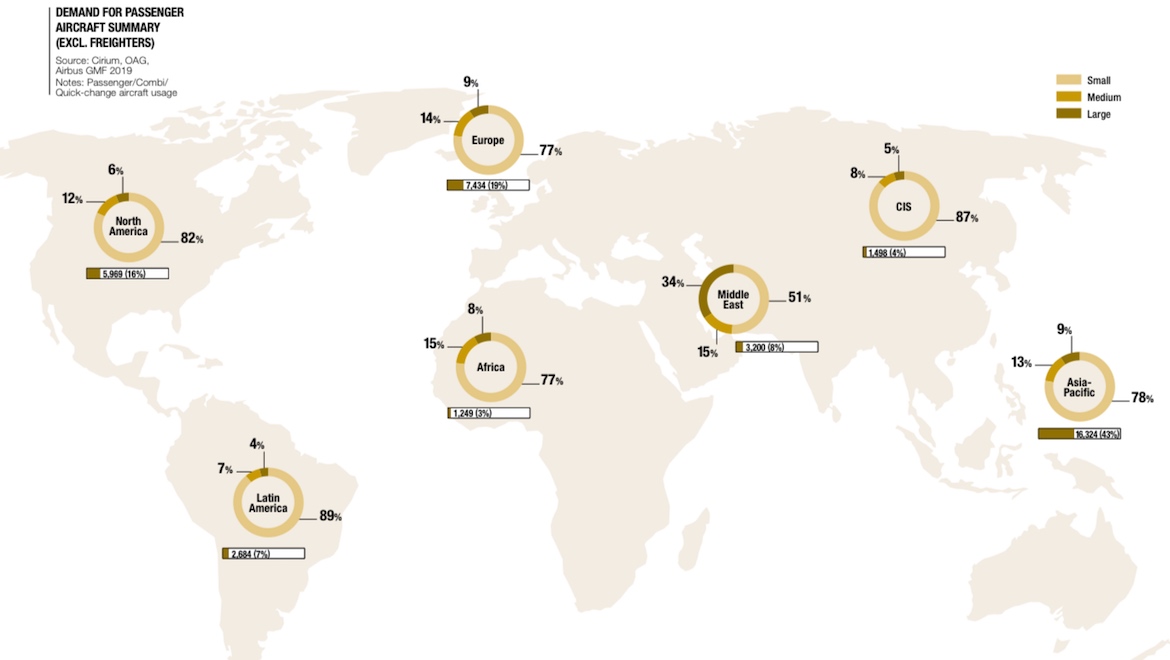

Forecast by market segment

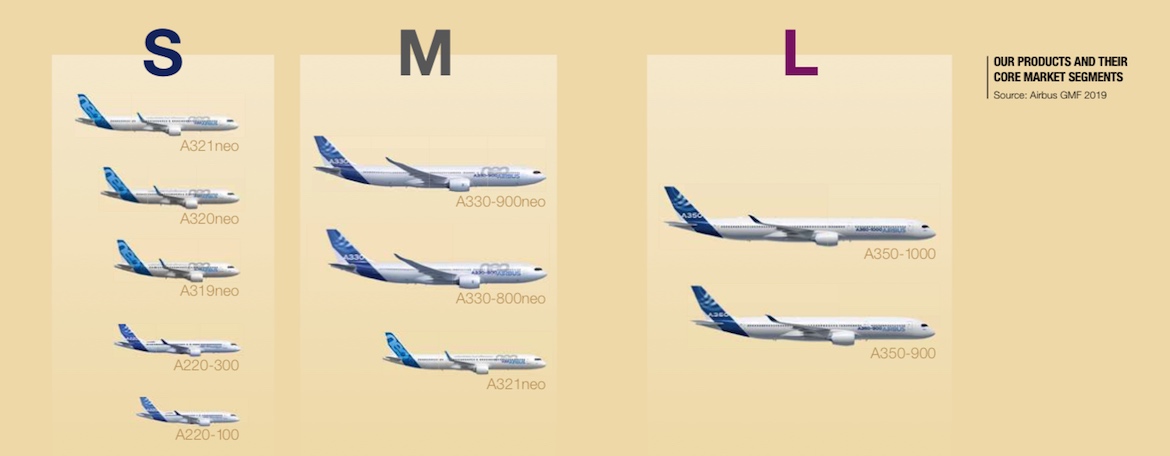

In 2018, Airbus sought to redefine the way it segmented the commercial aircraft market to more closely reflect the way airlines operated their fleets.

So instead of single-aisle, twin-aisle and very large aircraft, Airbus introduced four categories – small, medium, large and extra large.

For the 2019-2038 GMF, the extra large category has been omitted.

The GMF forecast demand for 29,720 new small aircraft deliveries over the next 20 years, representing about 76 per cent of total new deliveries. The figure was 4.1 per cent higher than 28,550 in the prior year’s estimates.

Meanwhile, the medium segment would comprise 14 per cent of new deliveries, or 5,370 aircraft, which was down from 5,480 aircraft forecast a year ago.

Finally, there was a substantial upward revision in the large segment, where Airbus expected 4,120 new aircraft deliveries in the coming two decades. This was up from a combined 3,350 aircraft in the large and extra large segments in the 2018-2037 GMF.

The total fleet around the world was expected to increase to 47,680 aircraft by 2038, from 22,680 currently.

To get there, Airbus expected 25,000 aircraft to be added for growth and 14,210 aircraft to replace older models.

Meanwhile, 8,470 aircraft in service today were expected to still be flying by 2038.

Airbus said in a statement developments in superior fuel efficiency were driving demand to replace existing less fuel efficient aircraft.

It forecast revenue passenger kilometres (RPK) would grow by 4.3 per cent a year for the next 20 years amid a expanding middle class and an aviation sector that was resilient to economic shocks.

“The four per cent annual growth reflects the resilient nature of aviation, weathering short term economic shocks and geo-political disturbances,” Airbus chief commercial officer Christian Scherer said in a statement. “Economies thrive on air transportation. People and goods want to connect.”

“Globally, commercial aviation stimulates GDP growth and supports 65 million livelyhoods, demonstrating the immense benefits our business brings to all societies and global trade.”

Looking closer to home, the GMF said the Asia Pacific region, including the likes of Air New Zealand, Fiji Airways, Qantas and Virgin Australia, would have the largest number of aircraft deliveries over the next two decades at 16,325. This was 2.7 per cent higher than 15,895 in the prior year’s GMF.

The 16,325 aircraft comprised 12,765 in the small category, 2,169 in the medium category and 1,391 in the large category.

The GMF noted the Asia Pacific would continue to lead the world in terms of economic growth with average real gross domestic product (GDP) growth of 4.1 per cent per year expected over the next two decades.

And while India had outpaced China in terms of economic growth in recent times, Airbus said Asia Pacific “remains linked to China and its transition to a service/domestic consumption based economy”.

“Concerns over slowing Chinese economic growth have eased recently but trade tensions with the United States are a downside risk at least in the short term,” the GMF said.

“New manufacturing hubs such as Vietnam and Indonesia are emerging which have the potential to stimulate traffic growth.

“Domestic and regional sources of growth – particularly private consumption – led by the Chinese economic transition to services, will play a larger role in the coming years.”

Further, the number of middle class in Asia Pacific was tipped to total 3.3 billion people by 2038, from two billion people today.