In this cross-posting with The Conversation, The University of Nottingham’s Roger Tyers explores how a policy introduced in the 1940s has kept demand subdued for low-emission alternatives to fossil fuels in aviation.

In this cross-posting with The Conversation, The University of Nottingham’s Roger Tyers explores how a policy introduced in the 1940s has kept demand subdued for low-emission alternatives to fossil fuels in aviation.

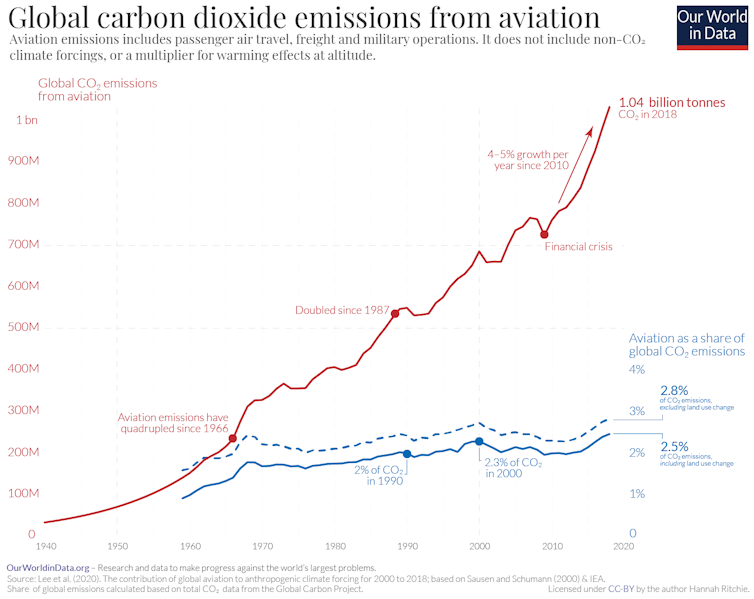

Before the pandemic, aviation was on course to be the UK’s most polluting sector and produce as much as 22 per cent of global emissions by 2050. The industry is suffering from low demand due to coronavirus restrictions, but without meaningful policy changes, flight numbers and emissions are expected to return to pre-COVID-19 levels by 2024.

When accounting for emissions, aviation is often seen as a special case because there is no alternative to flying at any meaningful scale without fossil fuels, unlike the energy sector, where there’s wind or solar, or land transport, where electric vehicles exist. But alternatives to fossil-fuelled flight do exist. Arguably, the most viable options are carbon-neutral synthetic fuels, which are made by combining carbon from air and hydrogen from water using electricity. These fuels wouldn’t require new fleets of aircraft and could be generated by capturing carbon directly from the air rather than taking more out of the ground.

So, why aren’t these innovations – alongside biofuels and electric planes – being adopted at a significant scale? To answer this question, we have to go as far back as the mid-1940s, when the aviation industry was just taking off.

A historical anomaly

The lifeblood of aviation is kerosene, a fossil fuel. Burning a tonne of kerosene generates about three tonnes of carbon dioxide. Burn 359 billion litres, as the aviation industry did in 2018, and you create about 900 million tonnes of CO₂ – more than Germany did that year.

The UN agency tasked with overseeing the aviation industry, the International Civil Aviation Organisation (ICAO), was established by the Chicago Convention in the aftermath of World War II. In a bid to stimulate growth in what was, at the time, a fledgling industry, the convention essentially banned governments from taxing kerosene for international flights and prohibited VAT on tickets. This enabled budget air travel, and along with other government subsidies, gave aviation a competitive advantage over ferries or night trains, which have a lower carbon footprint than flights but can’t compete on price.

Drivers pay a tax on motor fuel, and even drinkers pay taxes on beer and wine. It’s a historical anomaly that aviation, generally seen as the fastest way for individuals to warm the atmosphere, isn’t taxed according to the amount of fuel it consumes. As long as kerosene remains cheap and untaxed, there is little incentive for airlines to invest in low-carbon innovations.

On a wing and a prayer

Some argue that sovereign states can still override the ICAO’s aviation tax exemptions by renegotiating individual air service agreements, which are the bilateral treaties that govern flights between states. This has yet to be tested in court. But whether by unilaterally taxing fuel, amending bilateral treaties between countries or even adopting a fuel tax multilaterally through the EU or similar institutions, any such moves would likely lead to “tankering” – when carriers refuel outside a taxation zone. States feel powerless to go it alone and can conveniently delegate responsibility back to the ICAO.

The ICAO has a decent track record on harmonising rules on routes, safety and security between states. But its highly secretive nature, its susceptibility to corporate influence and its (conveniently) low public profile make it less well-suited to environmental policymaking. The responsibility for aviation emissions was only outsourced to ICAO due to an eleventh-hour decision at the Kyoto climate summit in 1997 that removed aviation from national carbon targets in order to get the rest of the agreement over the line. Progress since has been slow. As an industry insider once put it to me, “ICAO moves at a glacial pace, in an age of melting glaciers”.

After almost 20 years, ICAO did produce a scheme to mitigate emissions with efficiency measures, biofuels and by purchasing carbon offsets from other sectors, without limiting growth in air travel demand and supply. Sadly, the extremely low cost of offsets mean that cheap flights are likely to continue.

Governments can still impose taxes on tickets, instead of fuel, as the UK did with air passenger duty. These can be made fairer through a frequent flyer levy, which would ensure those who fly more pay more. For domestic flights – which are not subject to ICAO rules – governments have much more freedom to impose taxes so that trains are not so much more expensive than flights on similar routes, as they currently often are.

Local government has a role to play too. Aviation can only keep expanding if it’s given capacity to do so. The many UK councils considering airport expansions could fill the vacuum of responsibility left by nation states and the ICAO by rejecting such proposals. While that wouldn’t fix the problem, it would stop it getting worse.

It’s possible that national leaders at the Glasgow climate summit in 2021, exasperated by ICAO, will drag aviation into national carbon reduction targets. They might call for a worldwide, tapered phase-out of aviation kerosene, which could spark innovation in cleaner alternatives, as seen in the car industry with future bans on diesel and petrol vehicles. If not, national governments could make their own unilateral plans. If none of these things happen, then airlines will continue to enjoy lax regulation, and the aviation industry’s contribution to the climate emergency will only grow.