Singapore Airlines (SIA) reported a near halving of net profit in fiscal 2019 as higher fuel prices, overcapacity in some markets and operational challenges weighed on the bottom line.

The airline group comprising flying brands Singapore Airlines, regional wing SilkAir and low-cost carrier Scoot, as well as an engineering business, said net profit for the 12 months to March 31 2019 came in at S$683 million, down 47.5 per cent from S$1.3 billion in the prior corresponding period.

Revenue rose 3.3 per cent to S$16.3 billion, SIA said in a regulatory filing to the Singapore stock exchange on Thursday evening.

The company said the net profit result included a S$116 million impact from its share of losses at Virgin Australia during fiscal 2019, refleeting costs for SilkAir’s transition from Airbus to Boeing narrowbodies totalling S$60 million, as well as costs for the regional carrier’s eventual integration into the parent airline.

Nonetheless, operating profit, which removed one-off items and was regarded as the best indication of financial performance, fell 31.1 per cent to S$1.07 billion, from S$1.45 billion in the prior corresponding period.

Further, SIA said its total fuel bill for fiscal 2019 rose 25 per cent, or S$1 billion, to S$5 billion. Net fuel costs, which includes the benefits from its hedging policies, rose 17.6 per cent to S$4.6 billion.

Looking ahead, SIA said ongoing trade disputes and slowing economic growth in key markets posed uncertainty to the operating environment, while fuel cost headwinds “may persist on supply risks in the oil market”.

On a positive note, “growth in forward passenger bookings in the months ahead is tracking positively against capacity injection, with robust premium cabin demand”, SIA said.

“Most key markets, including those that have seen significant capacity growth such as the US, Japan, Indonesia and New Zealand, continue to grow at a healthy pace,” SIA said.

“However, China’s international traffic growth rates have softened, at a time of increased supply in the market.”

Global oil prices had a volatile past year. In October, Brent Crude Oil reached four-year highs of close to US$86 per barrel as tensions in the Middle East and the United States imposition of sanctions on Iran sent jitters through commodities markets.

Crude then began steady retreat to its lowest level in more than 12 months at about US$62 a barrel in December as fears of reduced supply from the Iran sanctions proved overblown.

However, an International Air Transport Association (IATA) report in May noted the decision by the US in early May to end waivers allowing some countries to import crude oil from Iran had led to an uptick in oil prices.

At May 10 2019, the IATA jet fuel price monitor showed the jet fuel prices was down 7.8 per cent from a year ago. However, it had increased 0.5 per cent from a month earlier.

Two of SIA’s three flying brands were profitable for the year, albeit at a reduced level.

Singapore Airlines posted an operating profit of S$991 million, a S$347 million reduction from the prior corresponding period.

Demand, measured by revenue passenger kilometres (RPK) rose seven per cent, while capacity, measured by available seat kilometres (ASK) increased by 4.5 per cent.

With demand growing faster than capacity, Singapore Airlines’ load factors improved two percentage points to 83.1 per cent, which the company said was the highest on record.

SilkAir posted operating profit of S$15 million in fiscal 2019, a near two thirds reduction compared with the prior year amid higher fuel costs and “competitive pressures and weakness of key revenue currencies”.

Meanwhile, Scoot swung into the red in fiscal 2019 with an operating loss of S$15 million, repressing a S$93 million turnaround from operating profit of $S78 million in the prior year.

SIA said the costs of the Scoot’s expansion – the LCC has been taking over routes previously served by SilkAir and/or Singapore Airlines as well as launching new long-haul routes – outweighed revenue growth.

“Performance was substantially affected by the slowdown in the rate of growth of Chinese travel,” SIA said of Scoot.

Scoot’s financial performance were also affected by the operational disruptions caused by ongoing engine maintenance issues on its Boeing 787 fleet.

Despite a disappointing fiscal 2019, SIA said Scoot had “continued to lay the foundations to benefit over the medium and long term from growth in the budget travel segment”.

The company’s other main business unit apart from its flying brands is SIA Engineering, where operating profit fell 27.8 per cent to S$57 million. SIA said there was lower airframe and fleet management activities in fiscal 2019.

SIA said its three-year transformation program, which was established in 2017, was continuing to progress well and had yielded revenue growth alongside improvements to operational efficiency and organisational structure.

“The group is well positioned to navigate through ongoing challenges in the operating environment,” SIA said.

SIA said it planned to grow capacity by six per cent in fiscal 2020, which was below the 6.4 per cent increase in ASK’s in fiscal 2019.

The company said a factor in the more moderate capacity increases for the current year was the grounding of the Boeing 737 MAX (operated by SilkAir) and the ongoing Rolls-Royce Trent 1000 engine maintenance issues for the 787 (operated by Scoot and Singapore Airlines).

In a slide presentation accompanying the financial results, SIA said it would extend aircraft leases to support the capacity shortfall and suspend plans to transfer Boeing 737-800s from SilkAir to Scoot “pending clarity” on the 737 MAX grounding situation.

In terms of the three individual airlines, Singapore Airlines and Scoot were projected to both increase ASKs by seven per cent, while SilkAir was forecast to reduce capacity three per cent.

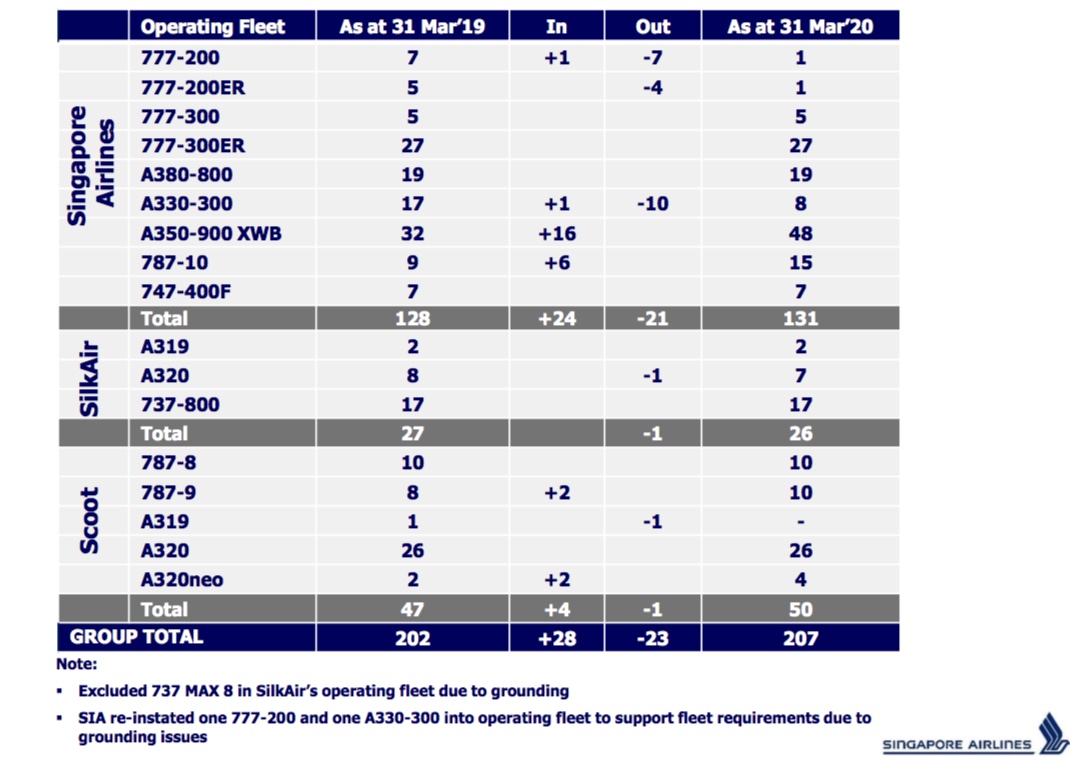

The airline group was expected to add a net five aircraft to the fleet in fiscal 2020.

Singapore Airlines was projected to increase its fleet by three aircraft to 131 aircraft, with 777-200s, 777-200ERs and Airbus A330-300s being withdrawn in favour of newer, more fuel efficient A350-900s and 787-10s

SilkAir was expected to withdraw one A320, bringing its fleet to 26 aircraft not including the grounded 737 MAX.

And Scoot was expected to add two 787-9s and two A320neos while withdrawing an A319, bringing its fleet to 50 aircraft.

Singapore Airlines is Australia’s largest foreign carrier, flying about eight per cent of all international passengers into and out of the country, according to figures from the Bureau of Infrastructure, Transport and Regional Economics (BITRE).

The airline group’s market share is even greater when Silkair’s flights to Cairns and Darwin and Scoot’s services to the Gold Coast, Melbourne, Perth and Sydney are included.

VIDEO: A look at the delivery of Singapore Airlines’ first Airbus A350-900 in March 2016 from the SIA YouTube channel.