Singapore Airlines (SIA) has reported a 20.7 per cent fall in net profit for the first quarter of its fiscal 2020 year as losses from its investment in alliance partner Virgin Australia weighed on the bottom line.

The company posted net profit of S$111.1 million for the three months to June 30 2019, down by a fifth from S$139.6 million in the prior corresponding period.

“The reduction was largely attributable to a higher share of losses from associated companies,” SIA said in a statement on Wednesday.

“An improvement in Vistara’s performance was offset by higher estimated losses from Virgin Australia.”

SIA’s first quarter accounts recognised a S$29.9 million loss from associated companies for the first quarter, compared with a $1.3 million profit in the prior corresponding period.

While SIA alliance partner Virgin Australia was yet to publish its financial results for the six months to June 30 2019, the airline issued an earnings downgrade in May that foreshadowed an underlying loss for the full 2018/19 financial year.

The May 17 trading update to the Australian Securities Exchange (ASX) said underlying earnings were expected to be “at least $100 million down on the FY18 comparative result of $64.4 million”.

The projected full year underlying loss “reflected the uncertainty in the domestic market and a $160 million impact from high fuel prices and foreign exchange movements”, Virgin Australia said.

Virgin Australia reported an eye-watering net loss of $681 million in 2017/18 as restructuring charges, writedowns and accounting adjustments weighed on the bottom line.

SIA, which owns about 20 per cent of Virgin Australia and has a seat on the board, said it its first quarter accounts the Australian carrier’s results were “estimated based on the published financial results as at 31 December 2018, and the company’s trading updates to the Australian Securities Exchange”, including the May 17 announcement.

On a more positive note, SIA said operating profit, which removed one-off items and was regarded as the best indication of financial performance, rose 3.6 per cent to S$200 million, from S$193 million in the prior corresponding period.

The Singapore Airlines operation, known within SIA as the parent airline company, posted operating profit of S$232 million, up 28.2 per cent from the prior year.

While strong revenue growth outpaced higher expenditure amid resilient passenger demand, the cargo market had weakened due to geopolitical concerns such as the trade disputes between major economies such as China and the United States.

“Passenger bookings in the forward months are tracking closely against capacity growth, supported by premium cabin traffic to key markets,” SIA said in a statement on Wednesday. “Air freight demand has softened amid ongoing trade disputes and uncertain global economic conditions.”

“These headwinds also cloud the outlook for passenger demand over the longer term.

“The group will actively capture revenue opportunities and exercise cost discipline to boost profitability in this challenging macroeconomic environment.”

SIA announced in late July it would increase its Singapore-Melbourne-Welligton service from four times weekly to five times weekly from January 1 2020.

The airline group’s engineering business also achieved operating profit growth, with the measure jumping 80 per cent to S$18 million, compared with S$10 million a year ago.

However, the operating profit result was weighed down by losses as regional wing SilkAir, which had a S$16 million loss for the three months to June 30, compared with a S$200,000 profit in the prior corresponding period.

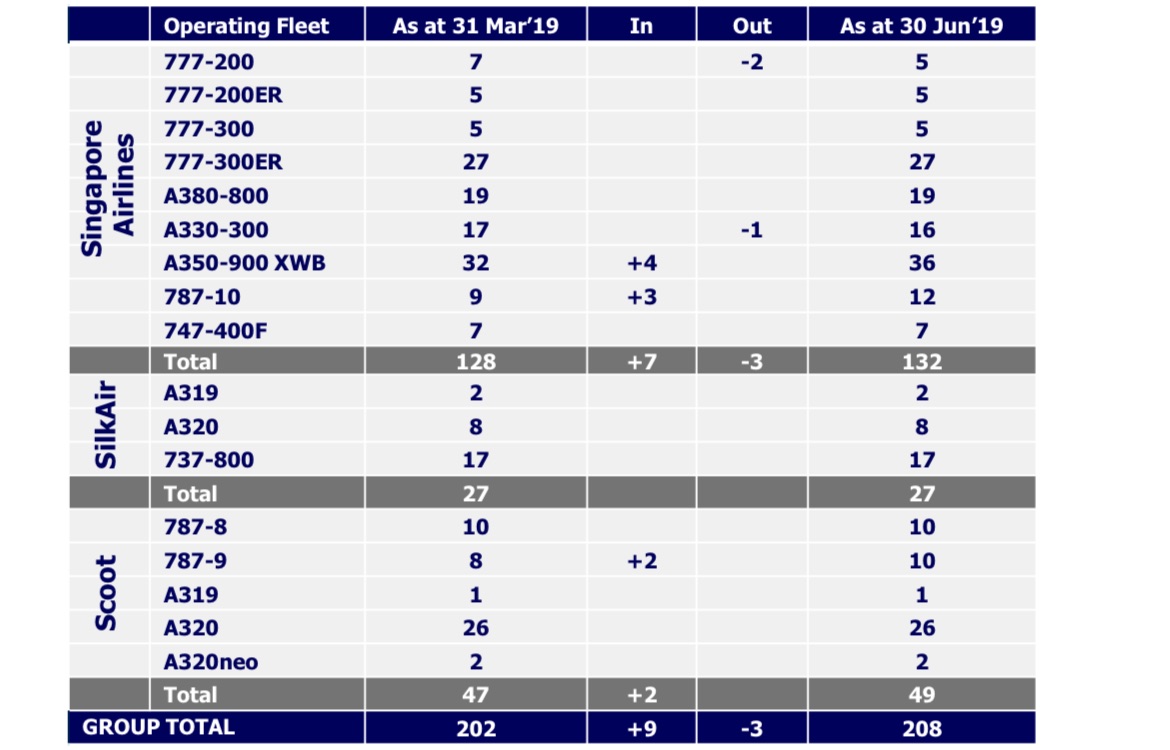

SIA said the global grounding of the Boeing 737 MAX had a “significantly impacted” SilkAir’s operation, with revenue down about 10 per cent in the quarter.

“The grounding of the 737 MAX 8 fleet has disrupted the Group’s operations and rate of expansion,” SIA said.

“While the fleet remains out of service, the Group continues to take active measures to mitigate the effects of the grounding.”

SIA’s low-cost carrier (LCC) business Scoot was also in the red after tumbling to an operating loss of S$37 million after a S$1 million operating profit a year earlier.

Scoot’s expenditure was up 10 per cent as the airline expanded its fleet and grew its network, while fuel costs rose 7.9 per cent.

In late July, Scoot announced an order for 16 Airbus A321neo narrowbodies with first delivery expected at the end of 2020.

The order comprised upgauging six existing orders for A320neo aircraft and 10 aircraft to be acquired via leasing companies. The aircraft will be configured with 236 seats in a single-class layout and powered by Pratt & Whitney engines.